Life Insurance in and around Baton Rouge

Coverage for your loved ones' sake

What are you waiting for?

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

When it comes to excellent life insurance, you have plenty of choices. Evaluating providers, riders, coverage options… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Joe Skibinski is a person committed to helping you create a policy for your specific situation. You’ll have a straightforward experience to get cost-effective coverage for all your life insurance needs.

Coverage for your loved ones' sake

What are you waiting for?

Love Well With Life Insurance

When it comes to deciding on what will work for you, State Farm can help. Agent Joe Skibinski can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include how old you are, your physical health, and sometimes even body weight. By being aware of these elements, your agent can help make sure that you get a suitable policy for you and your loved ones based on your specific situation and needs.

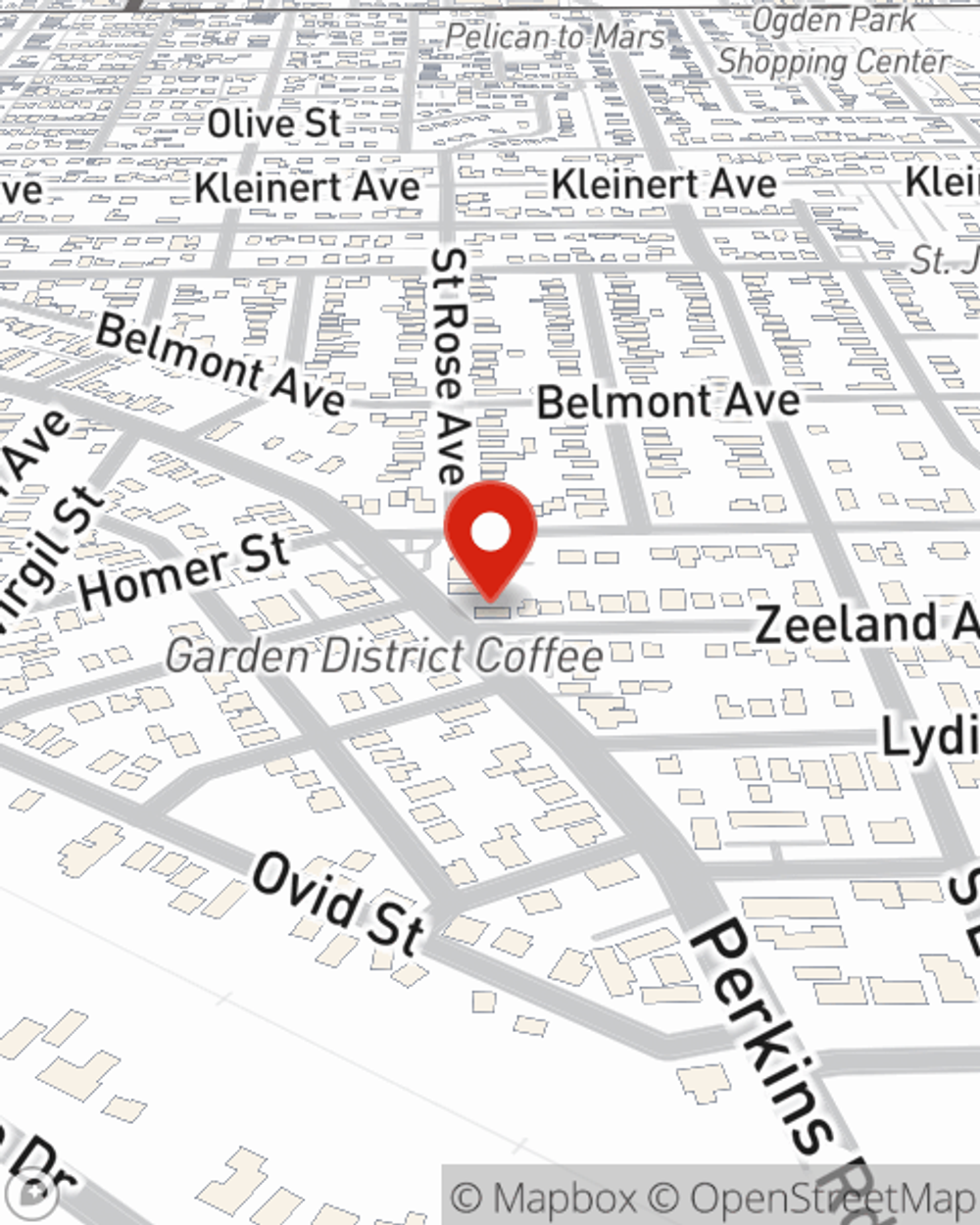

Contact State Farm Agent Joe Skibinski today to see how the trusted name for life insurance can care for those you love most here in Baton Rouge, LA.

Have More Questions About Life Insurance?

Call Joe at (225) 387-0201 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Joe Skibinski

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.